Table of Contents

Harmonized System Product codes (ITC HS Code search list)

Search HS Codes and products

What is an HS Code any Why HS Code is needed?

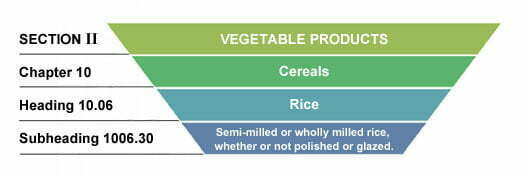

HS Code is sometimes also called as harmonized system of nomenclature, harmonized tariff code, HS Classification, harmonized system code etc. They all mean the same. It is basically a numerical code or representation given in an standard way to identify a product for trade. Actually using number we can manage the system in a easier way that is why products are categorized as HS code list.

Importance of import and export?

The HS code system is developed, maintained, and updated by the World Customs Organisation (WCO) as per the requirements. Nearly 200 countries follow these ITC HS code list as it is recognized at the international level. And it makes it very easy to identify a product by its code rather than using its name. You can compare it with the PIN code that we use for our cities. Over 98% of the goods involved in international trade are classified in terms of the HS Code.

- It is a six-digit identification code.

- It has 5000 commodity groups.

- Those groups have 99 chapters.

- Those chapters have 21 sections.

What Is The Difference Between ITC-HS Code And HS Code?

ITC stands for Indian Trade Classification or Indian Tariff Code. ITC-HS CODE CAN BE CALLED AS INDIAN VERSION OF THE HS CODE. ITC HS Code has an 8 digit nomenclature. The first 6 digits of the HS Code are the same for all the countries that follow WCO standards.

US (United States) HS code follows a 10 digit nomenclature system. Remember the first six digit is the same as the WCO standard.

The main difference between ITC-HS Code and HSN Code is that ITC has added further 2 digits in the 6 digit HS structure to classify “Tariff Items”. This addition has been done by following the existing rules of WCO without any changes in the existing structure.

What is the difference between the HS Code and HSN code list?

HS code is a six-digit nomenclature system, which is followed worldwide. But HSN code is an eight-digit nomenclature system generally called ITC HSN code (Indian Trade Classification or Indian Tariff Code Harmonized System of Nomenclature) especially followed in India.

Note: First six digit of both HS CODE and HSN CODE is the same.

(Chapter 1 – 5 ) – Section I- Live Animals; Animal Products

(Chapter 6-14 ) – Section II-Vegetable Products

(Chapter 25 -27 ) – Section V- Mineral Products HSN Code lists chapter

(Chapter 28 -38 ) – Section VI-Products of the Chemicals or Allied Industries

(Chapter 39 – 40 ) – Section VII-Plastics and Articles thereof Rubber and Articles Thereof

| Chapter 44: Wood and Articles of Wood; Wood Charcoal |

| Chapter 45: Cork and Articles of Cork |

| Chapter 46: Manufactures of Straw, of esparto or of other plaiting materials; basket ware and wickerwork |

(Chapter 50 -63 ) – Section XI-Textile and Textile Articles

| Chapter 68: Articles of stone, plaster, cement, asbestos, mica, or similar materials |

| Chapter 69: Ceramic Products |

| Chapter 70: Glass and Glassware |

(Chapter 72 -83 ) – Section XV-Base Metals and Articles of Base Metal

(Chapter 86 – 89 ) – Section XVII-Vehicles, Aircraft, Vessels and Associated Transport Equipment

| Chapter 90: Optical, Photographic, Cinematographic, measuring, checking, precision, medical or surgical instruments, and apparatus; parts and accessories thereof |

| Chapter 91: Clocks and watches and parts thereof |

| Chapter 92: Musical instruments; parts and accessories of such articles |

(Chapter 93 ) – Section XIX-Arms and Ammunition; Parts and Accessories thereof

| Chapter 93: Arms and Ammunition; Parts and Accessories thereof |

(Chapter 94 – 96 ) – Section XX-Miscellaneous Manufactured Articles

| Chapter 94: Furniture; Bedding, Mattresses, Mattress supports, cushions and similar stuffed furnishings; Lamps and Lighting fittings, not elsewhere specified or included; illuminated signs, illuminated name-plates and the like; Prefabricated Building |

| Chapter 95: Toys, Games and Sports Requisites; Parts and Accessories thereof |

| Chapter 96: Miscellaneous manufactured articles |

(Chapter 97 ) – Section XXI-Works of art, Collectors’ Pieces, and Antiques

| Chapter 97: Works of Art, Collectors” Pieces & Antiques |

(Chapter 98-99 ) – Section XXII- Special Classification Provisions; Temporary Legislation; Temporary Modifications Proclaimed pursuant to Trade Agreements Legislation; Additional Import Restrictions Proclaimed Pursuant to Section 22 of the Agricultural Adjustment Act, As Amended

Chapter 98: Special classification provisions

Chapter 99: Temporary legislation; temporary modifications proclaimed pursuant to trade agreements legislation; additional import restrictions proclaimed pursuant to section 22 of the Agricultural Adjustment Act, as amended

HS code search

Also, visit Foreign Trade Policy